Anti Money Laundering Procedures For Accountants

The idea of money laundering is essential to be understood for those working in the financial sector. It is a process by which soiled money is converted into clear cash. The sources of the money in precise are prison and the cash is invested in a manner that makes it look like clean money and conceal the identity of the criminal part of the cash earned.

While executing the monetary transactions and establishing relationship with the brand new prospects or sustaining present customers the obligation of adopting adequate measures lie on each one who is part of the group. The identification of such factor in the beginning is straightforward to cope with instead realizing and encountering such conditions in a while in the transaction stage. The central bank in any country supplies full guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such situations.

Accountants - Complying with the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 PDF 12MB Tax Transfers Explanatory Note September 2018 This explanatory note clarifies whether activities relating to tax transfers payments and refunds are captured activities for the purposes of the AMLCFT Act. To require accounting firms to institute an antimoney-laundering infrastructure.

An Introduction To The 360 Degree Aml Investigation Model Acams Today

Technical activities and advice.

Anti money laundering procedures for accountants. Managing your anti-money laundering risks is a legal requirement for accountancy service providers. If you havent given much weight to AML until now its definitely time for a rethink. Because the anti-money laundering regulations are here.

This guidance assumes that many businesses will find it easier to apply certain AML processes and procedures. Youre included in the supervised accountancy service providers or banks anti money laundering controls and procedures suspicious activity reporting and training programmes you have a. Tranche 2 of Australias anti-money laundering laws will expand accountants obligations but could also open opportunities.

Guide to the Anti-money laundering procedures manual for accountants Date. 44 行 Anti-money laundering procedures manual for accountants The Manual is. Even sole-practitioners benefit from a file note of procedures which could include having a diary note to attend a course providing money laundering update and a note of the money laundering helpline number to contact if they need any money laundering advice.

Accounting firms are likely to be required to educate their employees on money launderingrelated issues techniques and courses of action in cases where clients are suspected to be involved in money laundering. An Anti-Money Laundering AML Policy. In Brief The second phase of AMLCTF legislation already in force in NZ is expected to be before the Australian parliament in 2020 or 2021.

This guidance has been produced by the Consultative Committee of Accountancy Bodies and is based on law and regulations as of 26 June 2017. Thursday 25 October 2018 CPD hour. The template provides text examples instructions relevant rules and websites and other resources.

Anti Money Laundering AML for Accountants in the case of business relationships the date the relationship ceased. 113 Where the law or regulations require no specific course of action should is used to indicate good practice sufficient to satisfy statutory and regulatory requirements. And in the case of services provided the date the service was completed.

FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310. Anti-money laundering procedures manual for accountants. Guidance for those providing audit accountancy tax advisory insolvency or related services in the United Kingdom including such firms providing trust or company services on the prevention of money laundering and the countering of terrorist financing.

Anti-money laundering AML policy and procedures. This practical guide provides auditors accountants and tax practitioners with comprehensive information and useful tools in relation to anti-money laundering regulation and procedures. Anti-money laundering guidance for the accountancy sector.

And theyre not backing down. Welcome to the Anti-Money Laundering Guide previously named Money Laundering Handbook. 114 The UK anti-money laundering regime applies only to defined services carried out by designated businesses.

The guidance helps accountancy related businesses meet. You must consider the Money Laundering Regulations 2017 MLR 2017 and the CCABs Anti-Money Laundering Guidance for the Accountancy Sector. Stock is now available for purchase and collection in person at the Institutes Member Services Counter on 27th Floor Wu Chung House 213 Queens Road East Wanchai Hong Kong.

The policy sets out CNCFs basic goal and purpose so as to permit examination of funds disbursements accordingly and maintain information on the purpose and objectives of CNCFs. This section of the website provides guidance to assist members and firms to comply with the Criminal Justice Money Laundering Terrorist Financing Act 2010 Ireland as amended by The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 UK as amended by The Money. Decision to their anti-money laundering supervisory authority.

This factsheet will help shape your firms AML policy and procedures.

Mexico Real Estate Blog How Do Anti Money Laundering Regulations Affect Buying And Selling Prope Money Laundering Mexico Real Estate Anti Money Laundering Law

Know Your Anti Money Laundering Responsibilities Inside Out Aat Comment

Money Laundering Online Course John Academy Money Laundering Business Leadership Regulatory Compliance

Incorporate Singapore Company With Paul Hype Page Co An Acra Licensed Singapore Company Incorporation Sp Know Your Customer Chartered Accountant Informative

Following Recent Amendments To The Cayman Islands Anti Money Laundering Regulations 2017 And Guidance Notes Issued Money Laundering Fund Management Compliance

Casino Govt Regulations Include Safeguards Designed To Prevent Money Laundering By Junkets Infographic Money Laundering Prevention Infographic

Anti Money Laundering Aml Ranks As One Of The Top Priorities Of Banks Worldwide Regulatory Age Evaluation Employee Money Laundering Employee Evaluation Form

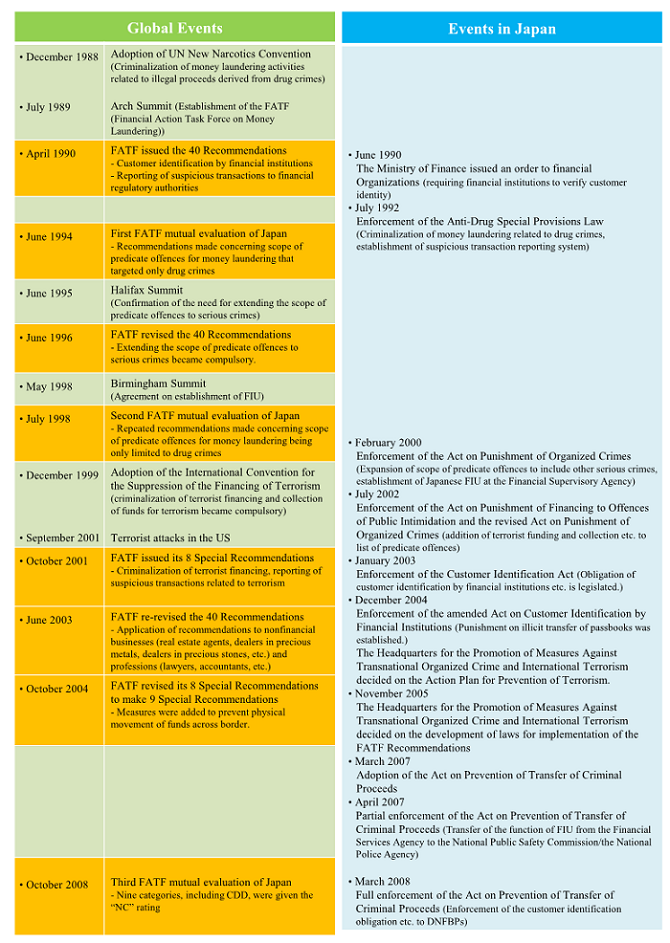

Anti Money Laundering Measures National Police Agency

Anti Money Laundering Measures National Police Agency

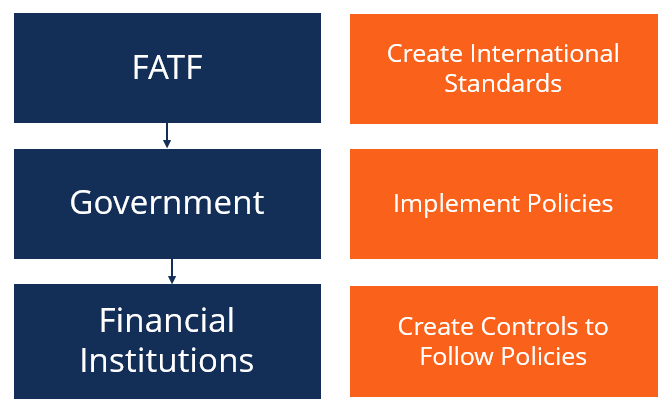

Anti Money Laundering Overview Process And History

Pdf Anti Money Laundering Regulations And Its Effectiveness

Key Component Of Aml Anti Money Laundering Compliance Program Plianced Inc

Anti Money Laundering Overview Process And History

The world of rules can seem like a bowl of alphabet soup at occasions. US money laundering laws are no exception. We have compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Risk is consulting firm targeted on defending monetary providers by lowering danger, fraud and losses. We've massive financial institution experience in operational and regulatory threat. We now have a robust background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many antagonistic consequences to the group because of the dangers it presents. It increases the chance of major risks and the opportunity cost of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment