Terrorist Financing And Proliferation Financing

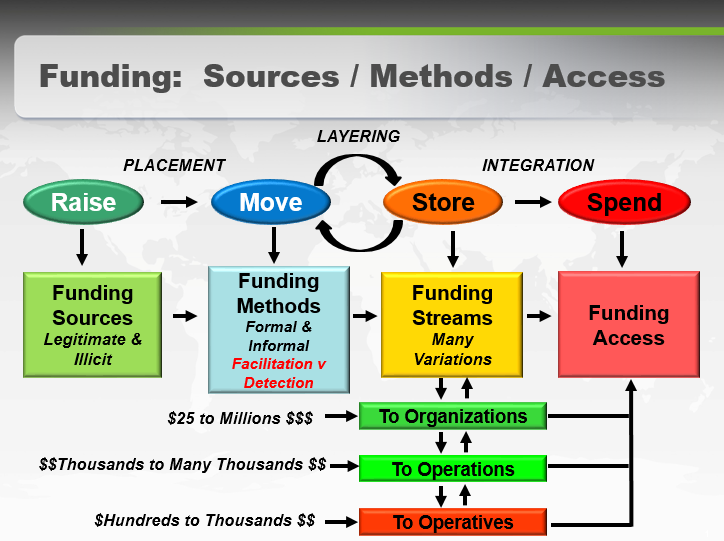

The idea of money laundering is very important to be understood for these working within the monetary sector. It is a course of by which dirty cash is transformed into clear money. The sources of the money in precise are prison and the cash is invested in a method that makes it appear to be clean cash and conceal the identity of the felony part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new customers or sustaining current prospects the responsibility of adopting ample measures lie on every one who is a part of the group. The identification of such factor at first is simple to cope with instead realizing and encountering such situations later on in the transaction stage. The central bank in any country supplies complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to discourage such conditions.

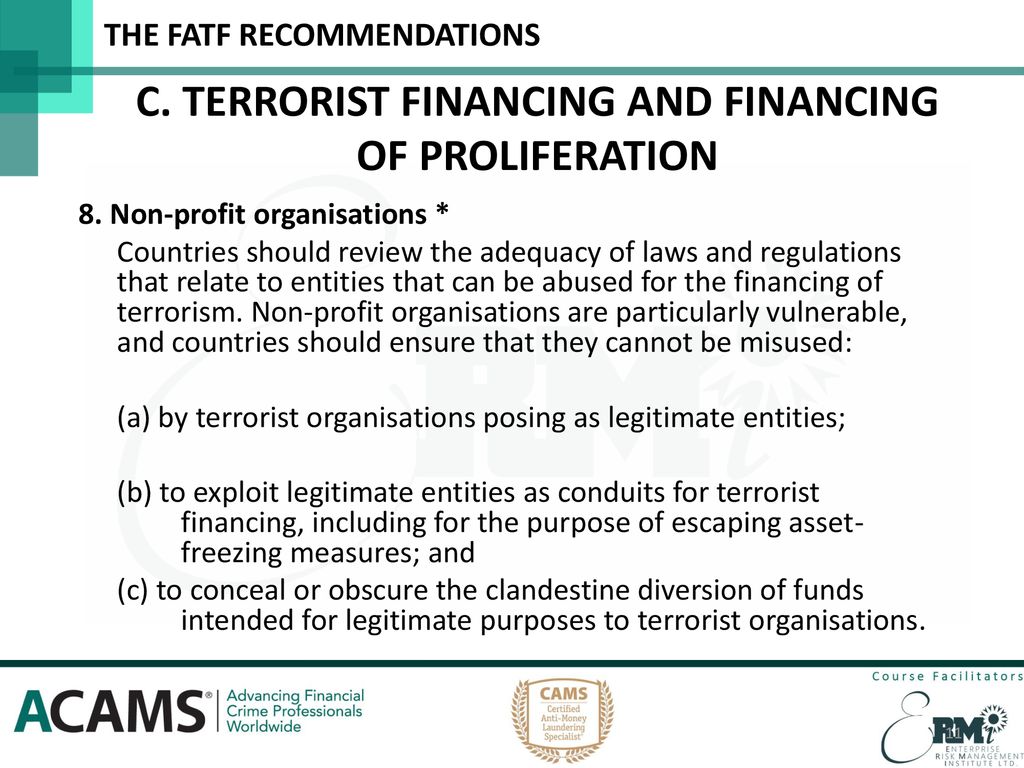

TARGETED FINANCIAL SANCTIONS for TERRORISM TERRORIST FINANCING PROLIFERATION FINANCING The Financial Action Task Force FATF defines Targeted Financial Sanctions TFS as both asset freezing and prohibitions to prevent funds or other assets from being made available directly or indirectly for the benefit of designated persons and entities. AND THE FINANCING OF TERRORISM PROLIFERATION The FATF Recommendations February 2012.

Anti Money Laundering Financial Crime The Fatf Recommendations Ppt Download

The changes may affect US.

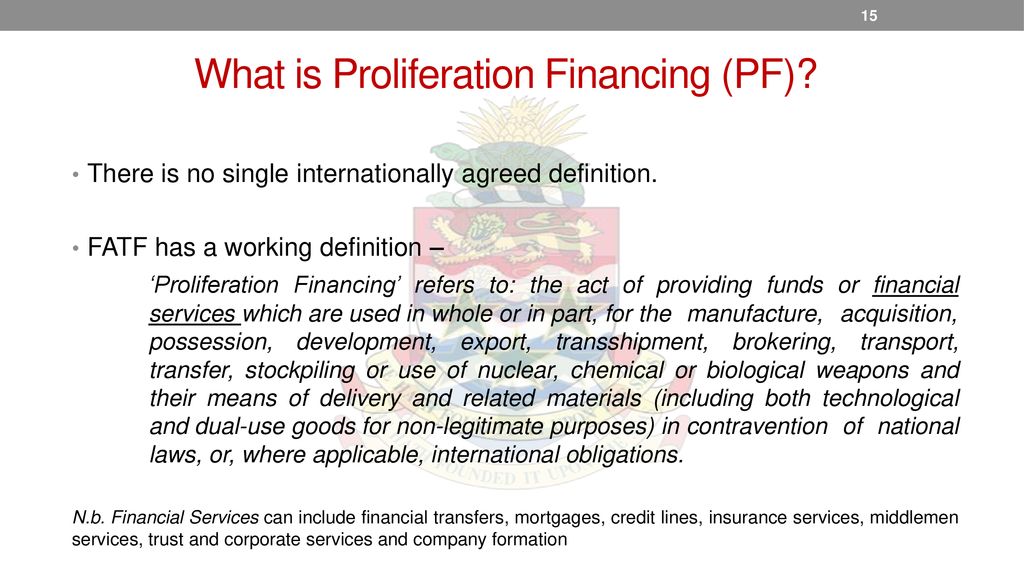

Terrorist financing and proliferation financing. Financial institutions are expected to make decisions about how to manage and mitigate money laundering terrorist financing and proliferation financing risks according to the size nature and complexity of the organization. On February 25 the US. Looking at proliferation financing challenges as related to export control efforts can significantly improve the overall national capacity of a given country to minimize proliferation financing risks.

As a bipartisan group the Task Force on Terrorism and Proliferation Financing is working to ensure this happens. The bipartisan Task Force on Anti-Terrorism Proliferation Financing works to educate Members and staff on the status of national and international efforts to track and stop the flow of funds to terrorist groups. Of all the many challenges in the financial crime arena the hunt for financial footprints tied to weapons of mass destruction has emerged as one of the most critically important.

Money laundering terrorist financing and the financing of the proliferation of weapons of mass destruction can have the following negative effects on a country including. Stephen Lynch D MA and Peter King R NY. An AMLCFT PF programme sets out the internal policies procedures and controls.

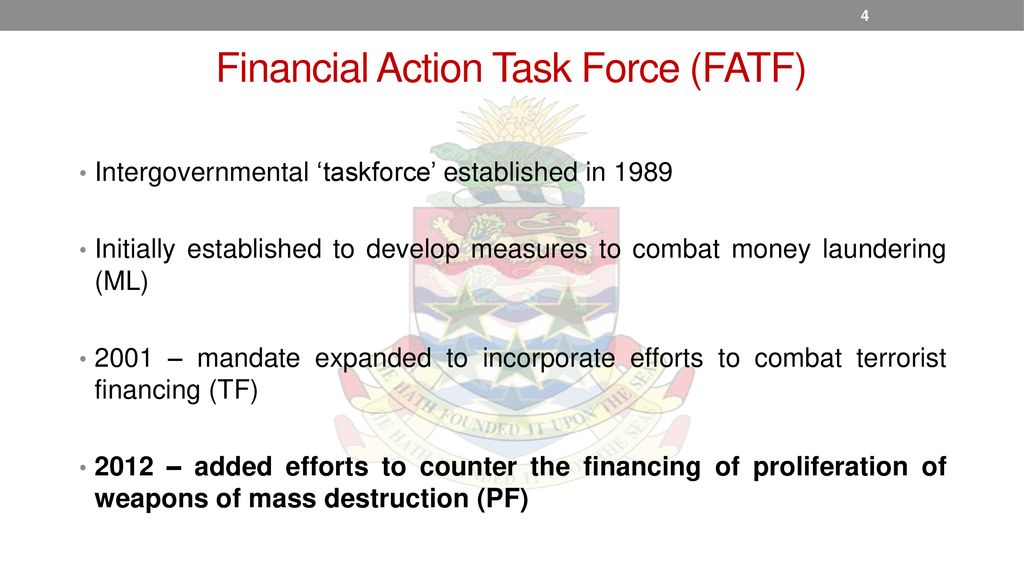

FATF steps up combating terrorist and proliferation financing. To date proliferation financing controls have mostly been seen as an add-on to anti-money laundering and counter-terrorism financing measures. The Financial Action Task Force on Money Laundering FATF is an inter-governmental organization formed in 1989 by the G-7 with the aim of developing systems and infrastructure to prevent and combat money laundering terrorism financing and funding for the proliferation.

Financial Crimes FATF Agency Rule-Making Guidance Combating the Financing of Terrorism Of Interest to Non-US Persons Anti-Money Laundering Virtual Currency. Treasury Department announced that the Financial Action Task Force FATF concluded. Though related to money laundering and terrorist financing proliferation financing presents its own unique set of issues.

Financial institutions can play a key role by identifying Terrorist Financing proliferation related financial transactions and reporting STRsSARs to the national authorities FIU Potentially vital contribution to maintaining international peace and security. Policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction. Promotes policies to protect the global financial system against money laundering terrorist financing and the financing of proliferation of weapons of mass destruction.

Financing of Terrorism and Counter-Proliferation Deficiencies On February 25 2021 the Financial Action Task Force FATF updated its list of jurisdictions with strategic deficiencies in their regimes to counter money laundering terrorist financing and proliferation financing. The FATF Recommendations are recognised as the global anti -money laundering AML and counter-terrorist financing CFT standard. Risks Threats and Mitigation.

Regulatory pressure on financial institutions to better respond to this threat has likewise grown. The recent enactments expanded the coverage of the Targeted Financial Sanctions TFS to include not just terrorism and terrorism financing but proliferation financing as well. Additional Chapters were included for de-listing from Anti-Terrorism Council designations Chapter 9 and a separate chapter for Targeted Financial Sanctions related to Proliferation Financing Chapter 10.

It is co-chaired by Reps. Counterparty shall include but not limited to o Suppliers o Contractors o service providers. Counter Proliferation Financing are the measures being undertaken to prevent the use of the Financial system to finance proliferation of weapons.

FINANCIAL ACTION TAS K FORCE The Financial Action Task Force FATF is an independent inter -governmental body that develops and promotes policies to protect the global financial system against money laundering terrorist financing. The FATF Recommendations are recognised as the global anti-money laundering AML and counter -terrorist financing CFT standard. Respect of preventing and combating money laundering ML terrorist financing TF and proliferation financing PF The Guidance Notes are based on the AMLCFT legislation of the Cayman Islands and reflect so far as applicable the 40 Recommendations and guidance papers issued by the Financial Action Task Force FATF.

IFFs hin-der economic development by draining capital from developing countries and reducing the amount of tax. Lynch is a member of the House Financial Services Committee. However proliferation might also be a means of supporting terrorist activities.

Money laundering terrorism financing and other illicit financial flows IFFs1 present significant chal-lenges to security and development underpinning transnational crime and terrorism networks. Counter Financing of Terrorism means the measures undertaken to tackle terrorist financing. For more information about the FATF please visitwwwfatf.

The Working Group on Terrorist Financing and Money Laundering WGTM Project Team on Proliferation Financing PFPT was created in October 2008 to develop policy options for the WGTM to consider as measures that could be considered in combating proliferation financing within the framework. For decades rogue states and terrorist groups have exploited the global financial system to finance the acquisition of goods and materials for their weapons of mass destruction WMD programs.

Anti Money Laundering And Counter Terrorism Financing

Proliferation Financing Pf Ppt Download

Virtual Currencies Regulation And Terrorist Financing Risks Acams Today

Combatting Money Laundering And Terrorist Financing Government Se

Anti Money Laundering And Counter Terrorism Financing

Dennis M Lormel S Statement Before The U S Senate Banking Subcommittee On National Security International Trade And Finance Hearing Acams Today

Proliferation Financing Pf Ppt Download

Anti Money Laundering And Counter Terrorism Financing

4 Differences Between Money Laundering And Terrorist Financing

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering Financial Crime The Fatf Recommendations Ppt Download

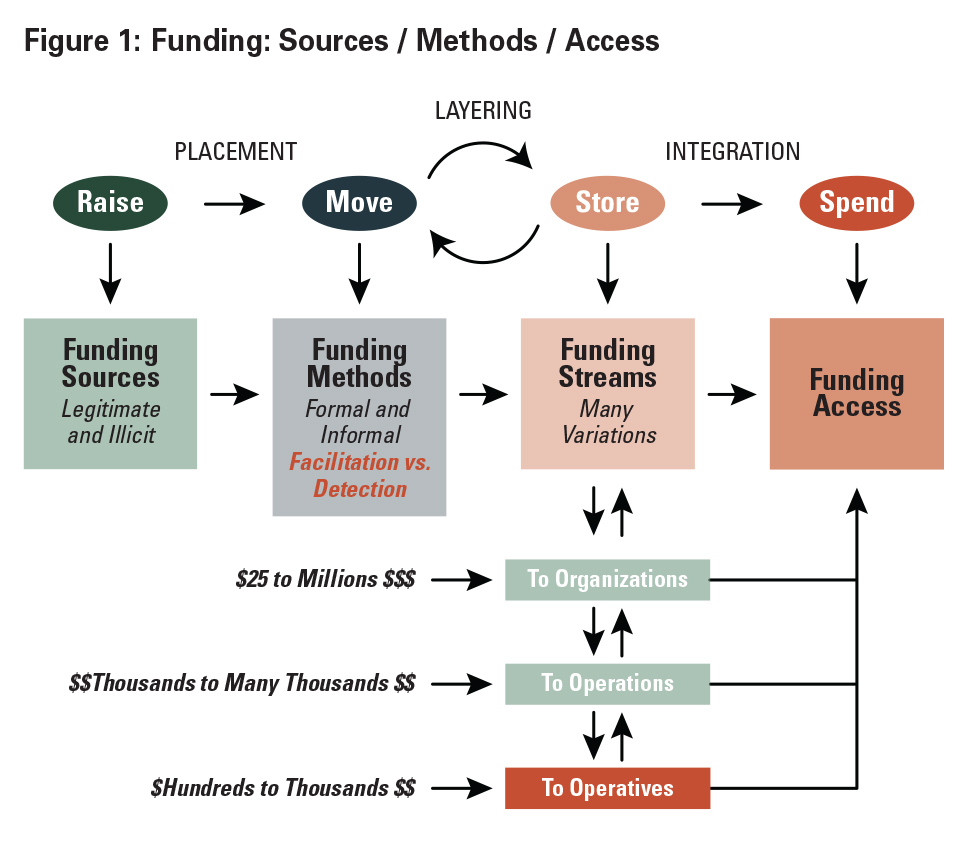

Terrorist Finance Figure 1 Acams Today

The world of rules can appear to be a bowl of alphabet soup at instances. US money laundering rules are not any exception. We now have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting firm targeted on protecting financial services by reducing threat, fraud and losses. We now have big financial institution experience in operational and regulatory threat. We've got a powerful background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many hostile consequences to the group due to the risks it presents. It increases the chance of major dangers and the opportunity price of the financial institution and finally causes the financial institution to face losses.

Comments

Post a Comment